Cryptocurrency arbitrage is an exciting and profitable way to invest in the world of digital assets. As a savvy investor, it is important to understand the fundamentals of cryptocurrency arbitrage so you can maximize your profits while minimizing your risk. In this article, we will cover the basics of cryptocurrency arbitrage, including the keys to maximizing your profits while minimizing your risk. By the end of this post, you will have all the tools you need to make smart, informed decisions when it comes to investing in the digital world.

Read More Article: Alex Reinhardt

Understanding Cryptocurrency Arbitrage

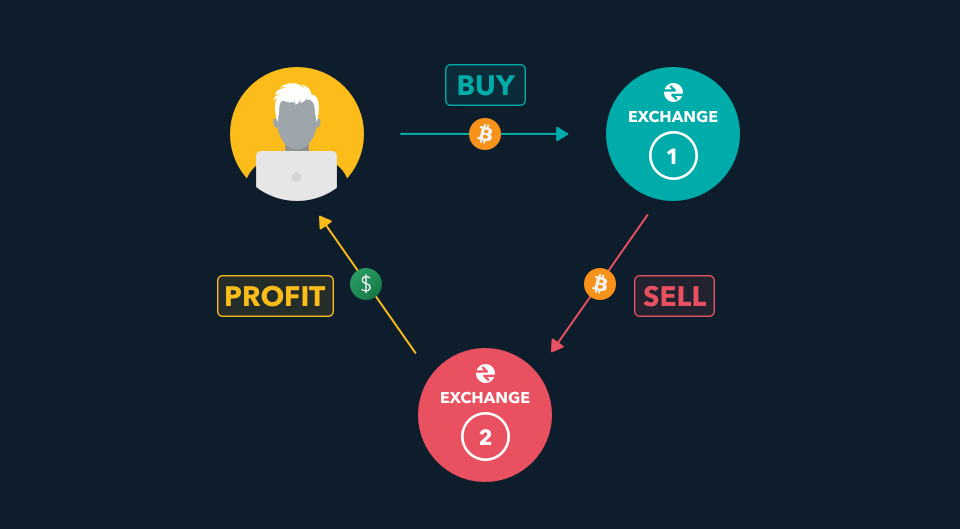

Arbitration trading is a strategy that allows investors to profit from price discrepancies between two or more different cryptocurrency markets. By buying cryptocurrencies in one market and selling them in another, arbitrage traders can make a healthy profit.

What is cryptocurrency arbitrage? Arbitration trading is the process of buying an asset and then immediately selling it at a higher price, typically because the asset is believed to be undervalued. Since cryptocurrency prices are highly volatile, arbitrage traders can make a lot of money by taking advantage of small price differences between markets.

How can you profit from arbitrage trading? The most common way to make money through cryptocurrency arbitrage is by purchasing an asset and then selling it at a higher price on another exchange. This often results in a gain of between 2% and 10%, although there are also opportunities for larger profits.

Why is it important to understand market trends? Understanding market trends enables you to capitalize on opportunities before they disappear – something that will maximize your chances for success with this strategy. By understanding which cryptocurrencies are being traded the most, you can get ahead of the competition and secure your position before prices change again.

What are the advantages and risks of cryptocurrency arbitrage? The main advantage of cryptocurrency arbitrage is that it allows you to trade assets that are usually not available for purchase outside of exchanges. This means that you can access markets that would be otherwise inaccessible or too risky for traditional investing methods. However, there are also risks involved with this strategy – both from within the Markets themselves as well as from external factors such as regulatory changes or hacks into exchanges. It’s important to understand these risks before beginning any investment campaign so that you’re making informed decisions about your future investments.

Exploring Risks and Benefits of Crypto Arbitrage Opportunities

Cryptocurrency arbitrage is a popular strategy that allows investors to capitalize on price discrepancies between two or more cryptocurrencies. By taking advantage of these price differences, investors can earn a profit by buying low and selling high. However, cryptocurrency arbitrage carries with it a number of risks and rewards that must be carefully analyzed before making any trades.

Related Info: Demystifying the Technology Behind Cryptocurrency

In this section, we will discuss the different types of cryptocurrency arbitrage, analyze market trends and data to identify high-probability opportunities, calculate costs and potential rewards of Arbitrage trades, risk management for Arbitrage traders, and leverage technology for efficient tracking of Arbitrage opportunities. We will also examine the legal implications of global crypto arbitrage. By understanding these details before conducting any transactions, you can maximize your chances of profitable cryptocurrency arbitrage trading.

Keys to Maximizing Your Profits While Minimizing Risk

Cryptocurrency Arbitrage is the process of trading one cryptocurrency for another with the hope of making a profit. This can be done on a variety of exchanges, so it’s important to understand the keys to success in this type of trading. By following these tips, you can maximize your profits while minimizing risk.

Strategies for Minimizing Risk in Cryptocurrency Arbitrage:

While there is always risk involved in any form of trading, there are several strategies that you can use to minimize this risk. First and foremost, always use caution when signing up for new exchanges – do your research first! Secondly, never invest more than you’re willing to lose – even in safe investments like cryptocurrency arbitrage! Finally, always keep an eye on market data and analytics in order to make better decisions about which coins to trade and at what rates. This will help ensure that you’re making maximal profits without taking too much risk.

Building a Long-Term Strategy is Essential: Even with all these precautions taken, there is still room for error or unexpected market conditions which could result in losses. It’s important not only to make quick decisions based on current market conditions but also to build plans for how YOU expect those conditions will change over time. This way, you’ll be prepared should opportunities arise but also able or unwilling (due to circumstance) t sustain long-term profitability. Follow our blog often as we will keep updating information about the latest developments affecting cryptos such as Bitcoin Cash ABC.

Strategies to Boost Your Profits with Cryptocurrency Arbitrage

Cryptocurrency arbitrage is the process of buying one cryptocurrency and selling another cryptocurrency at a different price. This allows you to make money by trading on price differences between the two cryptocurrencies. By doing this, you are taking advantage of the volatility of the crypto market.

Arbitration is a critical part of cryptocurrency arbitrage. By using an automated trading system, you can minimize your risk while still making profits. However, it is important to understand that risk management is essential when engaging in this type of trading. You should also be aware of fees associated with each strategy, as well as the importance of trend following when trading cryptocurrencies.

By reading this guide, you will learn about different strategies for making money with cryptocurrency arbitrage. You will also learn about how to stay up to date with market news and developments so that you can make informed decisions when engaging in this exciting trade-off.

To Summarize

Cryptocurrency arbitrage is a powerful tool for investors who are looking to capitalize on the volatility of the cryptocurrency markets. By understanding the fundamentals, analyzing market trends, and using automated trading systems, you can maximize your profits while minimizing your risk. As with any investment strategy, it is important to do your research and understand the risks before taking any action. Armed with this knowledge, you can be prepared to make smart decisions and take advantage of arbitrage opportunities in the cryptocurrency space. So, what are you waiting for? Start investing in cryptocurrencies today!